Route To Reserves

How to make your mineral exploration under cover programs more efficient and more effective: the right data types at the right scale in the right order. Featuring Bell Geospace, Southern Geoscience and Volatus Areospace. Brought together by Route To Reserves.

Graham Banks, Route 2 Reserves

Project chance of success in mineral exploration: province to district to prospect to portfolio

Introduction

The exploration business, like professional poker, is a game of risk played for high stakes. Since exploration is an economic activity, it must yield an acceptable Return on Invested Capital. During the last couple of decades the rate of success to discover major mineral deposits has been declining. To regain its mojo–and investor confidence–the mineral exploration sector must increase its overall efficiency and probability of success, and reduce geological uncertainties and risks, yet explore under sedimentary/vegetation cover.

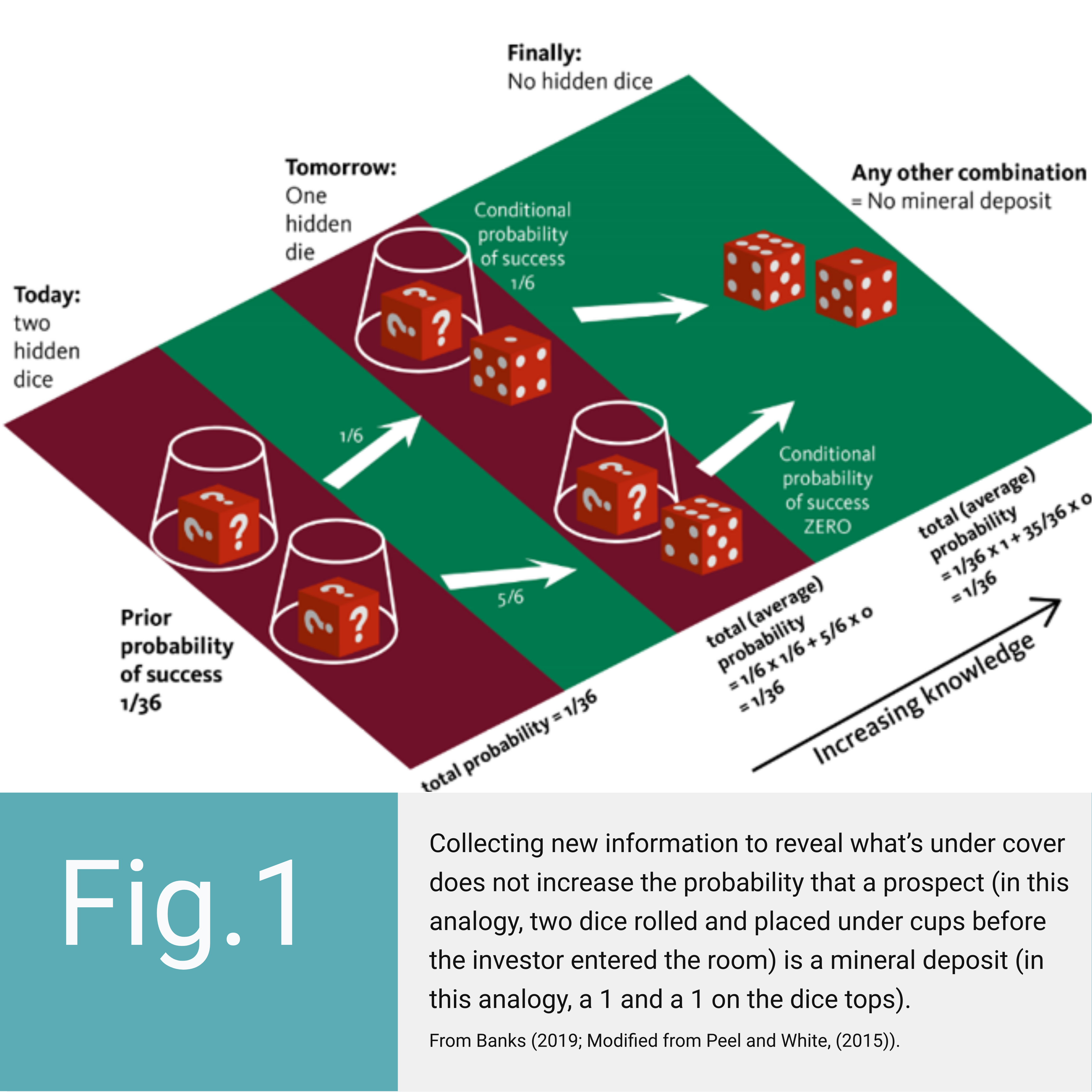

Mineral exploration programs acquire copious amounts of new geoscience data. However, this does not increase the value nor the geological chance of success (CoS) of a prospect, as the analogy in Figure 1 displays.

Laws of probability dictate that new information does not de-risk a project either (counter to popular belief), because Nature rolled the dice tens to billions of years before humans desired metals.

Hang on a minute! Why should companies spend exploration budget collecting new information if it does not increase a prospect’s CoS or geological value?

Because the value of acquiring new information is the ability it gives exploration decision-makers to make better decisions (Peel and Brooks, 2015), e.g., to drill prospects in profitable, under-explored regions and not waste budget drilling in low-profit or mature exploration areas. We collect new data to make success-case geological models more robust: by narrowing the uncertainty range of each input parameter used to calculate the possible resource size range of a mineral deposit.

Hopefully, exploration companies make pre-drill success-case geological models by predicting success case parameters. If not, a simple workflow is to translate a region’s mineral system into a targeting system, using the probabilistic risking method that is globally standard practise (and extremely successful) in petroleum exploration, carbon storage screening, weather forecasting, sports gambling, etc.

The Contextual Mineral System Approach

The contextual mineral system approach describes that one mineral deposit is just one small part of a larger, predictable, mineral system (e.g., McCuaig and Hronsky, 2014), i.e., one mineral deposit is just one focal point of a series of essential ingredients. This is a powerful logic. It enables mapping just a few geological processes that have a larger footprint than a prospect, to target for mineral deposits under sediment cover and in low data terranes. If one mineral deposit is then proven to be viable, statistical estimates about its undiscovered ‘sibling’ deposits can be used to evaluate an entire mineral system branch under cover.

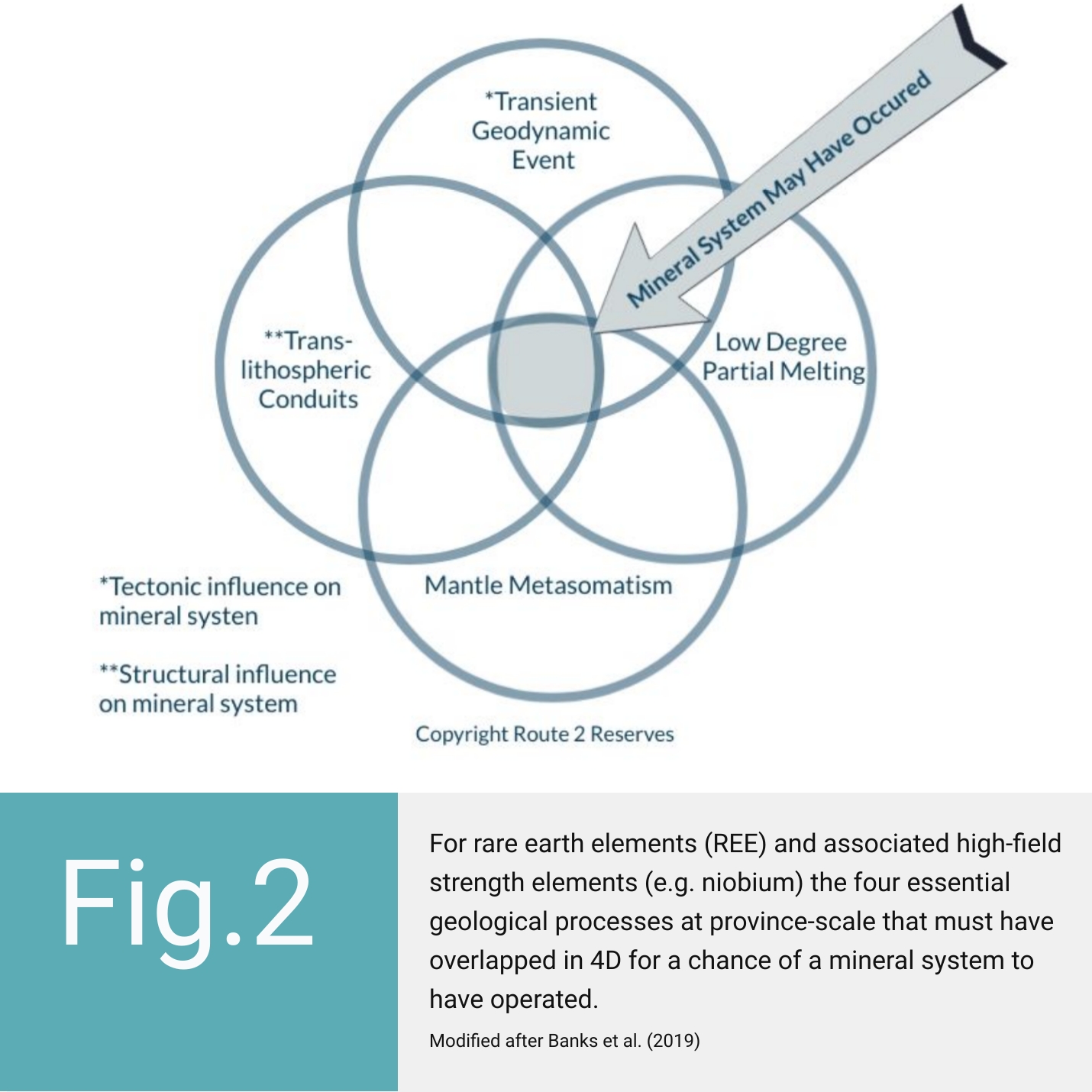

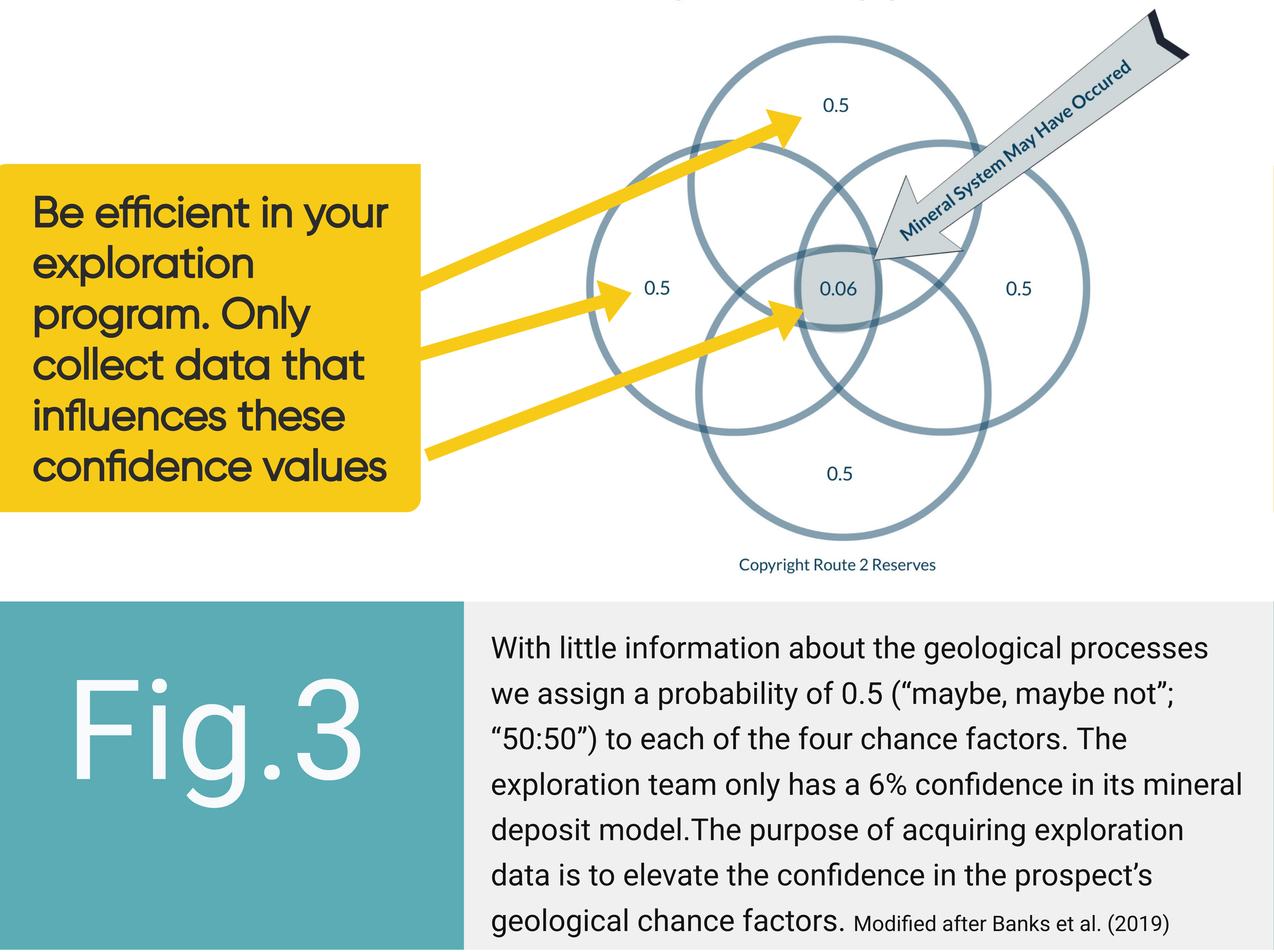

Recent work by Graham Banks of Route To Reserves–a structural geology, minerals systems and exploration risk consultancy (when he was part of the European Union’s HiTech AlkCarb consortium)–yielded a mineral system framework for rare earth elements from a probability of exploration success perspective. All the physical and chemical processes required for mineral deposit existence were distilled into four essential ingredients at each of the mineral system’s province, district and prospect scales. They were translated into the optimal data types required to detect an under cover mineral deposit. The elegance of this workflow is that an exploration team can quickly and cheaply map its confidence that these few geological chance factors overlapped in time and geographic volume. If one did not occur, or occurred out of sequence, then there is zero probability that a mineral deposit formed (Figure 2). This significantly simplifies the exploration process; companies only need to acquire data that increases the team’s confidence (expressed as a probability in %) that the few essential processes for mineral deposit formation have occurred.

An alliance, designed to bring efficiency to your projects

This mineral system logic has a backbone of geodynamic, tectonic and structural processes (e.g., transient geodynamic event and trans-lithospheric permeability on Figure 2) that can be [indirectly] visualised below-ground by geophysical methods. Route To Reserves has teamed up with three exploration geophysics companies. This alliance can help you efficiently design and interpret a mineral targeting workflow for critical metals, base metals and precious metals.

At province to district scale:

• Route To Reserves can assist you reconstruct the 4D evolution of the arc/belt/terrane

• Bell Geospace delivers airborne full tensor gravity gradiometry and magnetics for geological and structural mapping, such as locating faults and folds relating to subsurface architecture and mineralization

• Southern Geoscience Consultants (SGC) interprets and integrates your airborne and ground geophysical data with geology and geochemistry to provide a lithostratigraphic interpretation

For mineralized plays:

• Route To Reserves and associates integrate structural geology, sedimentary basin evolution and geophysics to map confidence about undefined mineral system branches

• Bell Geospace FTG will provide all gravity tensor components which relate to geological strike providing insight into the geological events that may have occured since the mineral system was formed

• SGC can provide and map comprehensive geophysical insight into target areas for follow-up

At prospect scale:

• Route To Reserves will assist you with code-compliant evaluation of your exploration project, to determine the project’s remaining geological risks, uncertainties and weakest links

• Bell Geospace FTG delivers interim products throughout acquistion ensuring objectives have been met even before the end of the survey. Bell offers in-fill on the fly, at tighter line spacing, for high resolution of areas of interest. This guarantees sufficient resolution across the whole prospect providing a confident base for future inversion and quantitative interpretation

• SGC helps your exploration team obtain maximum benefit from geophysical targeting programs: through the sequence of compiling historical data, to survey planning and contractor vetting, to acquisition QA-QC and 3D inversion, to integration and target identification

• Volatus Aerospace Corp. is Canada’s largest provider of unmanned, aerial technologies. Volatus can efficiently gather photogrammetry and video, LiDAR, magnetic, thermal and multispectral data during your exploration and mining programs

Prospect portfolio:

• Route To Reserves will guide you to rank and prioritize your prospect portfolio or project areas by their chance of geological success

Conclusion

This group of companies can assist you during your entire exploration programme by acquiring, interpreting and integrating your exploration data ‘under one roof’–sequentially through, province, district, prospect to portfolio scales–to optimise your data acquisition programs and drilling decisions.

Let’s return to this blog’s first question. Why should companies spend exploration budget collecting new information if it does not increase a prospect’s CoS or geological value? Well, if an exploration team has little information about the geological processes required to form a mineral deposit (because it is buried under sediment or in a frontier exploration region), the team would assign a probability of 0.5 (“maybe, maybe not”; “50:50”) to each of the four chance factors. Since they were independent geological processes, then 0.5 x 0.5 x 0.5 x 0.5 = a prospect chance of success of 0.06. The exploration team has only a 6% certainty in its success case geological model. Hence, the purpose of acquiring exploration data is to elevate the team’s confidence in the prospect’s geological chance factors. However, most outcomes of interpreting new data will be that the prospect’s chance of success has decreased, and to cease collecting data (as Figure 1 shows; Peel and White, 2015). This enables prospects in a portfolio to be rated and prioritized by prospect chance of success, regardless of deposit type or commodity.

Sounds Interesting?

Ask the alliance of Route To Reserves, Bell Geospace, Southern Geoscience Consultants and Volatus Aerospace Corp. how to make your mineral exploration under cover programs more efficient and more effective: the right data types at the right scale in the right order.

You may use the form below to add a comment to this article.

Receive Bell Geospace Articles To Your Inbox

Would you like to receive the next installment directly to your email?